The Complete Guide to Cyber Insurance Costs

The risk of cyber attacks is no longer hypothetical; it’s an expensive reality. According to a recent Cybersecurity Ventures report, global cybercrime is predicted to escalate to more than $20 trillion by 2026.

“In today’s uncertain digital landscape, having a cyber insurance policy is essential for businesses due to the constant presence of digital threats,” says Chris Butler, Executive VP of IP Services.

Knowing cyber insurance costs is vital for today’s business owners. This guide provides in-depth insights into how much coverage might cost to help you make informed choices for your business’s protection.

What is Cyber Insurance?

Cyber insurance serves to mitigate financial damages resulting from digital attacks. This type of policy typically covers costs related to data breaches, cyber-attacks, and interruptions to business operations.

With the average expense of a security breach reaching $4.88 million in 2024, securing a cyber insurance plan is indispensable for businesses, regardless of size or industry.

As a business leader, grasping the importance of cyber insurance and how it safeguards your operations is crucial.

Who Should Consider Cyber Liability Insurance?

1. Every Modern Business

Any business that utilizes technology for data processing or storage should consider cyber liability insurance. From small retail shops to major enterprises, the risk of data exposure is universal.

2. Industries with Elevated Risks

Companies in sectors like healthcare, finance, and retail are especially susceptible to cyber-attacks due to the large volumes of sensitive data they handle. In one recent example, more than 100 million Americans’ medical records were exposed in a large-scale breach impacting clients of UnitedHealth.

3. Businesses Handling Online Transactions

Research shows that e-commerce businesses have lost over $48 billion as a result of data breaches. Therefore, any organization conducting online transactions should prioritize cyber insurance to help mitigate potential financial and legal repercussions.

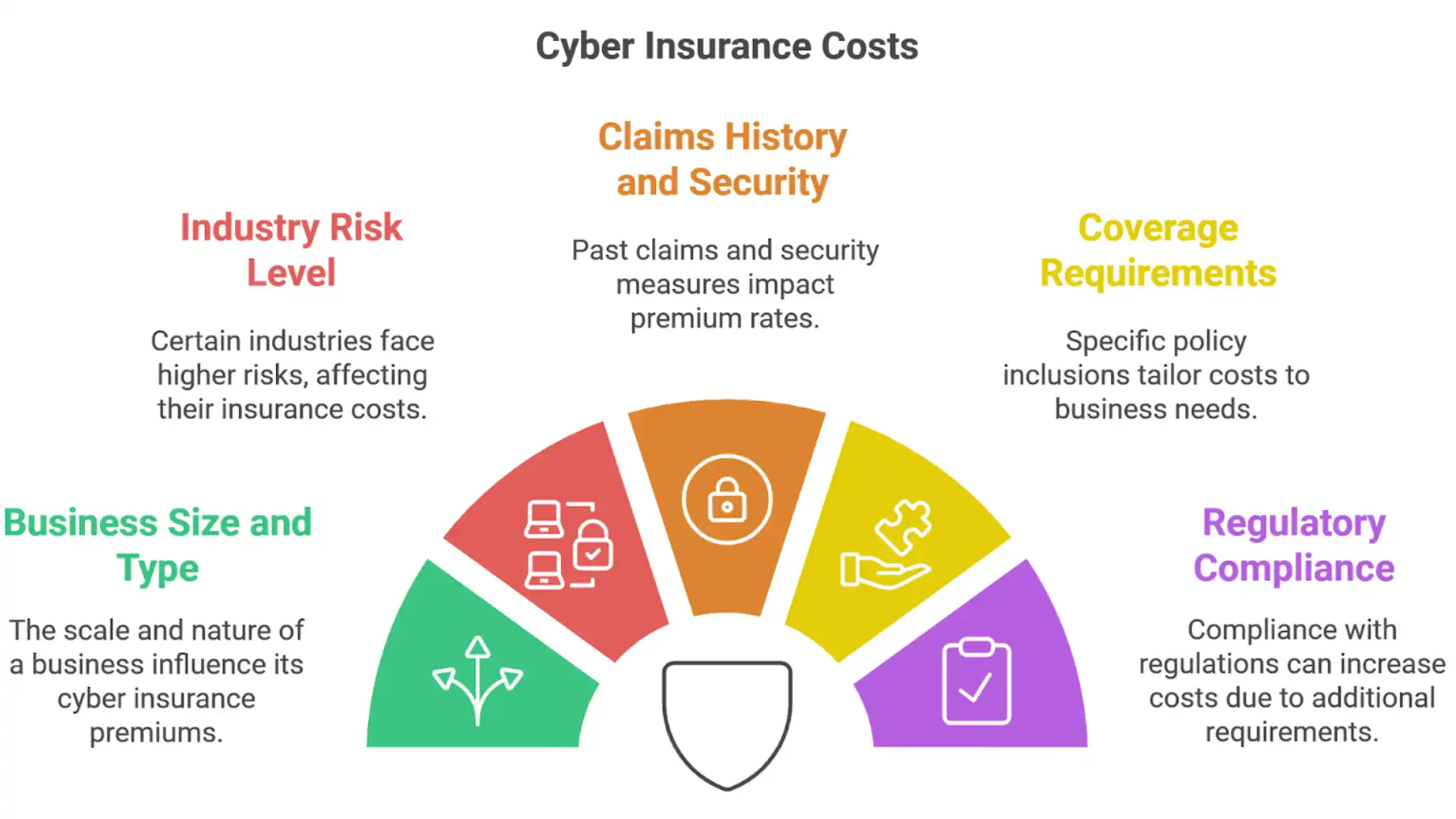

Primary Factors Influencing Cyber Insurance Costs

1. Business Size and Type

The size and nature of your business play a significant role in cyber insurance costs. Larger organizations often face higher premiums due to the complexity of their operations and increased exposure to cyber threats.

2. Industry Risk Level

As noted earlier, certain sectors are more prone to cyber risks, leading to higher premiums. Compliance with industry regulations can also drive up cyber insurance costs for regulated businesses.

3. Claims History and Security Preparedness

A history of frequent claims can raise your premiums. Conversely, demonstrating a strong security posture by implementing protective measures can show insurers your commitment to risk reduction, potentially lowering your rates.

4. Specific Coverage Requirements

Your policy’s specific inclusions, such as third-party coverage, business disruption, and data breach protections, will impact the overall cost. Customizing your plan to meet your company’s unique needs can often be more economical.

5. Policy Limits and Location Organizations

Companies based in areas with higher cybercrime rates or stringent data protection regulations may encounter higher cyber insurance costs.

6. Regulatory Compliance

Businesses operating in heavily regulated industries may face additional expenses due to the need to comply with legal and regulatory standards. Non-compliance penalties can be severe, with potential fines reaching nearly $15 million.

| More articles you might like: |

Making Sense of Cyber Insurance Costs and Trends

The question of “How much does cyber insurance cost?” doesn’t have a one-size-fits-all answer. For small businesses, monthly premiums typically start around $145, totaling approximately $1,740 annually, depending on factors such as coverage scope and risk exposure.

However, it’s worth noting that 38% of small businesses manage to pay less than $100 monthly for their premiums. For larger companies, premiums can easily surpass tens of thousands of dollars annually.

Balancing Coverage and Costs

Striking the right balance between sufficient coverage and cost management is essential. To achieve this, businesses should:

- Invest in advanced security measures

- Conduct comprehensive risk assessments

- Periodically update their policies to reflect new and emerging threats

Looking Ahead: Future Trends in Cyber Insurance Costs

Data from Howden shows that cyber insurance rates were 15% lower in 2024 than the market’s peak back in mid-2022. However, despite this, the cyber insurance market is slated to experience growth and innovation in the future.

With rates constantly changing, being proactive and well-informed is crucial to managing these cost fluctuations effectively.

Factors that Influence Cyber Insurance Costs

|

Factor |

Impact on Cyber Insurance Costs |

Management Tips |

|

Business Size |

Larger businesses tend to pay higher premiums due to increased risk and potential impact. |

Scale your coverage based on actual needs and consider modular policies. |

|

Industry Risk Profile |

High-risk industries like healthcare and finance face higher costs. |

Invest in industry-specific cybersecurity measures to mitigate risks. |

|

Claims History |

A history of multiple claims raises premiums. |

Maintain a clean claims record by implementing preventive measures and employee training. |

|

Security Posture |

A weak security framework results in higher premiums. |

Implement robust cybersecurity protocols to show insurers you are proactive about risk reduction. |

|

Coverage Specifics |

Broader coverage options will increase overall costs. |

Tailor your policy to focus on the most relevant risks to your business. |

|

Geographic Location |

Companies in areas with higher cybercrime rates may see increased costs. |

Partner with local experts to ensure compliance with regional cybersecurity regulations. |

|

Regulatory Environment |

Heavily regulated sectors incur extra costs to meet compliance standards. |

Regularly review and update practices to meet regulatory requirements and avoid non-compliance penalties. |

Get Expert Guidance on Cyber Insurance Costs from a Trustworthy Partner

Managing cyber insurance costs and finding the right policy can be a complex process. If your business requires guidance on navigating cyber insurance, IP Services can assist.

Our team of cybersecurity specialists leverage their expertise to advise you on selecting suitable policies and implementing strong security practices that reduce your risk profile, making your business more attractive to potential insurers.

Strengthen your cybersecurity posture by contacting us today for more information and to schedule a consultation.