What is Data Breach Insurance and Why Does Your Business Need It?

The risk of cyberattacks has become a daily reality for businesses of all sizes. Every organization, whether it manages customer data, intellectual property, or internal files, faces the potential threat of a breach that could expose sensitive information and result in costly losses.

According to IBM’s 2024 Cost of a Data Breach report, the average data breach now costs businesses $4.88 million, an expense that cannot be overlooked.

Chris Butler, Executive VP of IP Services, notes that “Data breaches are no longer a matter of if, but when. Every organization must prepare for the inevitable”.

With cyber threats becoming more sophisticated, understanding data breach insurance and its critical role in your risk management plan is key.

Understanding the Importance of Insurance Against Data Breach

Cyberattacks are evolving, and so are the strategies businesses must adopt to prevent and recover from them. According to CloudSecureTech, 60% of small companies that get hit by a cyber attack go out of business within six months.

Data breach insurance is a vital tool in any company’s cybersecurity arsenal. The rising costs of breaches, not to mention the reputational damage, highlight the importance of having an insurance policy to mitigate the financial burden.

What Does Data Breach Insurance Cover?

Data breach insurance covers a wide range of expenses that businesses incur following a breach. These can include:

- Notification Costs: After a breach, you’re legally required to inform affected parties. This includes customers, clients, and possibly even government authorities. Insurance covers these notification costs, which can quickly add up.

- Legal Fees: Lawsuits from customers, clients, or regulatory bodies are common after a breach. The cost of defending your business in court can be enormous, but insurance against data breach helps cover these legal expenses.

- Public Relations and Reputation Management: One of the hardest aspects to recover from is the damage to your company’s reputation. Data breach insurance provides coverage for PR campaigns and crisis management to restore consumer trust.

- Remediation and Investigation: Determining how a breach occurred and fixing the vulnerabilities that led to it can be time-consuming and costly. Cyber data breach insurance covers investigation and remediation services, including forensic investigations, to understand the scope of the breach.

- Regulatory Fines and Penalties: Depending on the jurisdiction, fines for failing to protect data or comply with industry regulations can be substantial. Insurance helps offset these costs.

The Role of Cyber Data Breach Insurance in Your Cybersecurity Strategy

While data breach insurance plays a critical role in managing the financial fallout of a breach, it should not be seen as a substitute for a robust cybersecurity strategy. A strong cyber data breach insurance policy will work hand in hand with your proactive cybersecurity measures.

For example, businesses should implement the following best practices in addition to holding insurance:

- Encrypt sensitive data: Protecting data with encryption ensures that, even if a breach occurs, the information remains unreadable.

- Regular software updates and patches: Keeping systems up to date helps close security loopholes.

- Employee training: Mistakes by employees cause 88% of data breach incidents. Regular training in identifying phishing attempts and maintaining good password hygiene can reduce these risks.

Cyber insurance is only as effective as the safeguards you’ve put in place to prevent the breach in the first place.

| More articles you might like: |

How to Choose the Right Data Breach Insurance for Your Business

Not all data breach insurance policies are created equal. Consider the following factors when selecting your policy to ensure you’re properly protected:

- Assess Your Business’s Risk: Understand what data you hold, how sensitive it is, and where it’s stored. For example, a company handling financial data may face greater risks than one that deals primarily with non-sensitive information.

- Scope of Coverage: Ensure the policy covers all potential costs, including legal fees, notification expenses, and remediation costs. The best policies also include coverage for reputational damage and regulatory penalties.

- Exclusions: Every policy has exclusions. Be sure you’re clear on what’s not covered, such as breaches stemming from employee negligence or insufficient cybersecurity practices.

- Insurance Provider Reputation: Choose a provider known for its expertise in cyber data breach insurance and its track record of responding swiftly when claims are made.

As your business grows, so should your data breach insurance coverage. Regularly review your policy to ensure it keeps pace with evolving threats and your company’s changing needs.

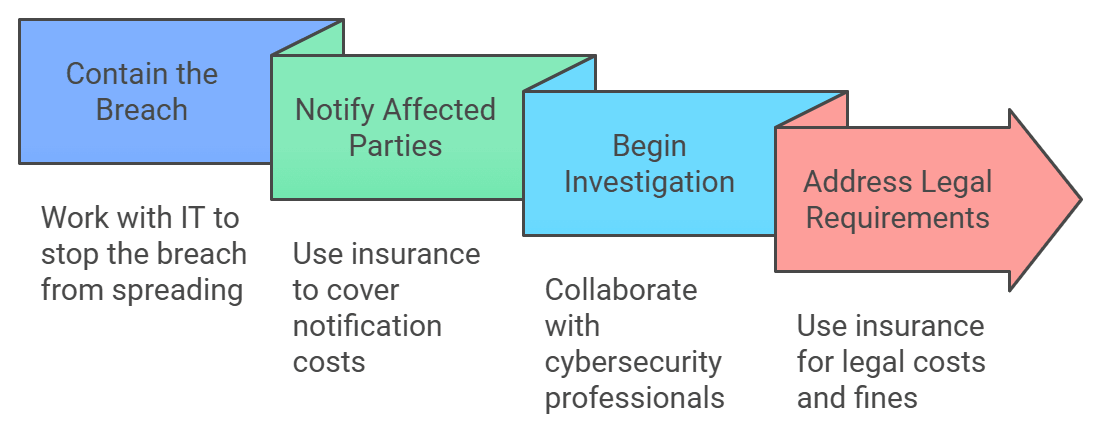

What to Do After a Data Breach: How Insurance Can Help

Even the most secure organizations can experience a data breach. Insurance against data breaches doesn’t guarantee immunity but can help you recover quickly. Here’s what to do immediately after a breach:

- Contain the Breach: Work with your IT team or a managed security services provider to stop the breach from spreading.

- Notify Affected Parties: Use the insurance coverage to help cover the costs of notifying affected customers, clients, or vendors.

- Begin the Investigation: Work with a cybersecurity professional to determine how the breach occurred. Your insurance policy can help fund this investigation.

- Address Legal and Regulatory Requirements: If necessary, your insurance policy can cover any fines or legal costs that result from the breach.

Integrating Data Breach Insurance with Your Risk Management Plan

For data breach insurance to be truly effective, it must be part of a comprehensive risk management strategy. Work with a managed security services provider to:

- Develop a Cybersecurity Roadmap: This should detail how you will manage risk and respond to incidents.

- Incorporate Insurance into Your Plan: Ensure your insurance policy aligns with your business continuity plan, cybersecurity policies, and overall risk management strategy.

An MSSP can also help you identify areas of vulnerability and guide you in selecting the right cyber data breach insurance policy that fits your unique business needs.

Key Factors Influencing the Cost of Data Breach Insurance

|

Factor |

Impact on Premium |

What to Consider |

|

Size of Your Business |

Larger businesses with more data and employees may face higher premiums. |

Ensure that your coverage scale matches the size of your operation. |

|

Industry |

Certain industries, like finance and healthcare, are considered higher risk. |

Understand industry-specific risks and compliance requirements. |

|

Data Sensitivity |

The more sensitive your data (e.g., health, financial), the higher the cost. |

Determine how much sensitive data you manage and its value. |

|

Cybersecurity Measures |

Businesses with strong cybersecurity in place may receive discounts. |

Review your current security protocols to potentially reduce premiums. |

|

Claims History |

A history of previous claims can increase premiums. |

Maintain a clean claims history to keep costs down. |

Safeguard Your Business with Comprehensive Data Breach Insurance

The rise in cyberattacks and data breaches makes it essential for businesses of all sizes to invest in data breach insurance. By offering coverage for notification costs, legal fees, remediation efforts, and reputational damage, insurance against data breach allows you to recover faster and reduce the financial burden.

Working with experts, including your MSSP, is vital to ensure that your cyber data breach insurance policy fits within your broader risk management framework.

At IP Services, we specialize in reducing the risks of cyberattacks for businesses seeking comprehensive protection. Contact us today to learn more and schedule a consultation.